Saving for Retirement as a Software Engineer

Take 100 young Americans starting out at age 25. By age 65, one will be rich and four will be financially independent. The remaining 95 will reach the traditional retirement age unable to self-sustain the lifestyle to which they have become accustomed. - The Bogleheads’ Guide to Investing

This is intended as a bare-bones intro to saving for retirement, targeted at software engineers. When I got my very first paycheck after college, I was fortunate enough to have a friend pull me aside and give me the benefit of their experience regarding saving. I didn’t know what a 401k was! If this describes you too, then listen up!

The average salary for a software engineer in the Bay Area ranges from $73k at entry level to $124k for a senior software engineer. Ballpark, you make about $100k a year in your 20s. If you want to have that same income in retirement, you need about four million dollars saved up. Anything less, and your income will be lower than it was in your 20s (adjusted for inflation).

That’s a BIG number. If you are a dual income family, you may very well need twice that amount. The good news is that you can do it!

Compound Interest

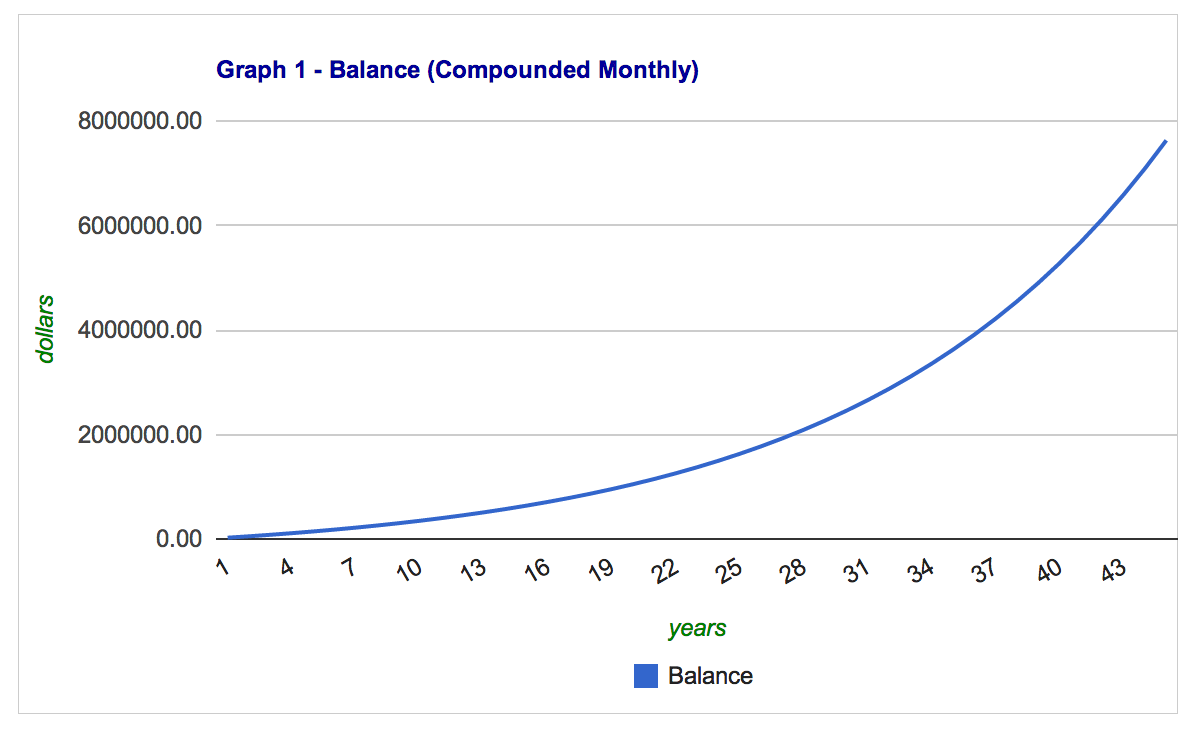

If you save approximately 25% of your gross income (pre-tax), then you can easily get there. But if you work until you’re 65, that will be “only” $25k * 45 years, or $1.125m. Where does the other $3m come from? Stop me if you’ve heard this before. The secret is the power of compound interest.

Compound interest arises when interest is added to the principal of a deposit or loan, so that, from that moment on, the interest that has been added also earns interest. -Wikipedia

The stock market has historically returned about 9.5% annually over the last 100 years. Some years it’s negative, but other years are way up. A more conservative estimate that you often hear is 7%.

Over time, that 7% interest will overtake your actual cash deposits into your savings. Your savings will be growing more and more due to interest than anything else.

If you save $25k a year for 45 years at 7% interest, you will end up with $7.6m. Start just 10 years later at age 30, and you will have $3.6m. Feel free to play around with a compound interest calculator yourself.

401ks

A 401k is a service offered by many employers where a set dollar amount is deducted from your paycheck before taxes and sent to a financial institution, where it is automatically invested into funds of your choice. An individual can contribute up to $17.5k a year to a 401k. Many larger companies also offer a dollar match, which can put you above the $17.5k limit.

If you work at a company the offers a match, that’s free money! It’s definitely something to think about the next time you get a job offer.

The money you contribute will grow, tax free, until you turn 59.5. At that point, you can start withdrawing the money, and you will pay taxes on it at that time. You can also make early withdrawals for specific things like buying a house and going back to school. When you leave your current company, you can roll your 401k over to your new employer, or into a third-party financial institution.

The main advantages of a pre-tax savings are:

- It reduces your taxable income for that year.

- You can afford to save more, so your savings will reach a higher peak value.

- When you do pay taxes on the money in retirement, your tax rate will likely be lower.

- You can choose to retire in a state with lower taxes.

For me, the primary advantage is that it’s automatic. It happens before you even see the money.

How Fees Kill You

Most companies do not manage their own 401k plans. Instead, they outsource it to someone like Fidelity, Schwab or Vanguard. You might think that, like a bank, just having the utility of your money would be compensation enough for these companies. But in reality, they charge high maintenance fees. Most companies pass these costs on to their employees.

As exposed in a 60 minutes episode last year, most employees don’t realize they are paying these fees. Indeed, if you ask your 401k provider point blank about costs, they will likely tell you that there are no fees.

This is technically true, but ingenuous. What is happening is that you elect to put your savings into one or more mutual funds. Those mutual funds have what’s called a load, also known as an expense ratio. The load is a fee; it’s a percentage that the fund managers charge you every year. Average mutual fund loads are in the 1.3% to 1.5% range. Your typical 401k will raises these loads by as much as a full percentage, to 2.3% to 2.5%, and pocket the difference.

That’s the difference between making a 7% return on your investments over time, or making 6%. Here again the magic of compound interest is at work, but this time it’s to your disadvantage. A 1% difference in return rates could cost you 30% of your retirement savings over 45 years.

This is just over 20 years. Notice that the gap is widening over time! Not all providers charge this much. Vanguard, for example, is known for low fees. However, the employee at a company usually has no control over which provider the employer uses.

Index Funds

Even if your 401k provider does not add much load to your funds, you still have the base load of the fund itself. This is the aforementioned 1.3% to 1.5%. These fees go primarily to the bottom line profit of the fund managers themselves, with some portion going to trading fees overhead.

You’re effectively paying these managers 1% of your savings every year to invest your money for you. These are known as actively managed funds. But there are also index funds.

Index funds are not managed by a person, but by an algorithm. They closely follow some well-known index like the S&P 500. As a result, they provide a return rate very close to the overall return rate of the stock market in general, and do it with much lower fees, typically in the 0.1% range.

Do actively managed funds out perform index funds, to justify their extra fees? Many industry experts don’t think so:

Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals. - Warren Buffett

Only about one out of every four equity funds outperforms the stock market. That’s why I’m a firm believer in the power of indexing. - Charles Schwab

Mr. Schwab is talking about a single year. The chances of an actively managed fund beating an index vanish to almost zero over larger times scales:

If you go back to 1970, there were only 355 equity funds. Only 169 of them survive today, so right away you are dramatically skewing the numbers by not counting the losers. Of those 169 survivors, only nine beat the S&P 500 through 1999. - John Bogle

Other Vehicles

There are many other types of retirement savings accounts. Here are a few:

Traditional IRA

Also pre-tax, but limited to $5k a year. There are also income limits. For example, if are married and make over $115k combined, then your contributions to a traditional IRA are no longer tax deductible.

Roth IRA

With a Roth IRA, you put money in after taxes, but the proceeds are not taxed when you withdraw them in retirement. There is a limit of $5.5k. One interesting difference is that you can take funds out of a Roth IRA at any time with no penalty. You can also convert a traditional IRA to a Roth IRA at any time by paying the taxes due. Roth IRAs have their own income limits; you can’t contribute at all as a married couple making over $178k.

403b, SEP, Pensions

These are not commonly available to software engineers.

How to Start

The best time to plant a tree was 20 years ago. The second best time is now. – Chinese Proverb

If you can’t swing $17.5k a year just yet, you can surely do 1% of your gross pay. Getting started is as easy as logging in to your 401k provider’s website, setting a dollar amount and a percentage split of one or more funds. Hopefully you now have some idea of what funds to pick. But you can hardly go wrong! Saving something in ANY account is better than saving nothing.

Many providers allow you to automatically increase your percentage over time, say by 1% a year. Another common tactic is to start low, but when you get a raise put the additional amount into your 401k.

More Reading

For those interested, I would recommend the following resources: